1. Long-horizon forecasting

In some cases, it is necessary to forecast long horizons. Here “long horizons” refer to predictions that exceed more than two seasonal periods. For example, this would mean forecasting more than 48 hours ahead for hourly data or more than 7 days for daily data. The specific definition of “long horizon” varies depending on the data frequency.

There is a specialized TimeGPT model designed for

long-horizon forecasting, which is trained to predict far into the

future, where the uncertainty increases as the forecast extends further.

Here we will explain how to use the long horizon model of

TimeGPT via nixtlar.

This vignette assumes you have already set up your API key. If you haven’t done this, please read the Get Started vignette first.

2. Load data

For this vignette, we’ll use the electricity consumption dataset that

is included in nixtlar, which contains the hourly prices of

five different electricity markets.

df <- nixtlar::electricity

head(df)

#> unique_id ds y

#> 1 BE 2016-10-22 00:00:00 70.00

#> 2 BE 2016-10-22 01:00:00 37.10

#> 3 BE 2016-10-22 02:00:00 37.10

#> 4 BE 2016-10-22 03:00:00 44.75

#> 5 BE 2016-10-22 04:00:00 37.10

#> 6 BE 2016-10-22 05:00:00 35.61For every unique_id, we’ll try to predict the last 96

hours. Hence, we will first separate the data into training and test

sets.

test <- df |>

dplyr::group_by(unique_id) |>

dplyr::slice_tail(n = 96) |>

dplyr::ungroup()

train <- df[df$ds %in% setdiff(df$ds, test$ds), ]3. Forecast with a long-horizon

To use the long-horizon model of TimeGPT, set the

model argument to timegpt-1-long-horizon.

fcst_long_horizon <- nixtlar::nixtla_client_forecast(train, h=96, model="timegpt-1-long-horizon")

#> Frequency chosen: h

head(fcst_long_horizon)

#> unique_id ds TimeGPT

#> 1 BE 2016-12-27 00:00:00 42.73280

#> 2 BE 2016-12-27 01:00:00 38.03184

#> 3 BE 2016-12-27 02:00:00 35.11706

#> 4 BE 2016-12-27 03:00:00 34.53464

#> 5 BE 2016-12-27 04:00:00 34.11326

#> 6 BE 2016-12-27 05:00:00 38.361804. Plot the long-horizon forecast

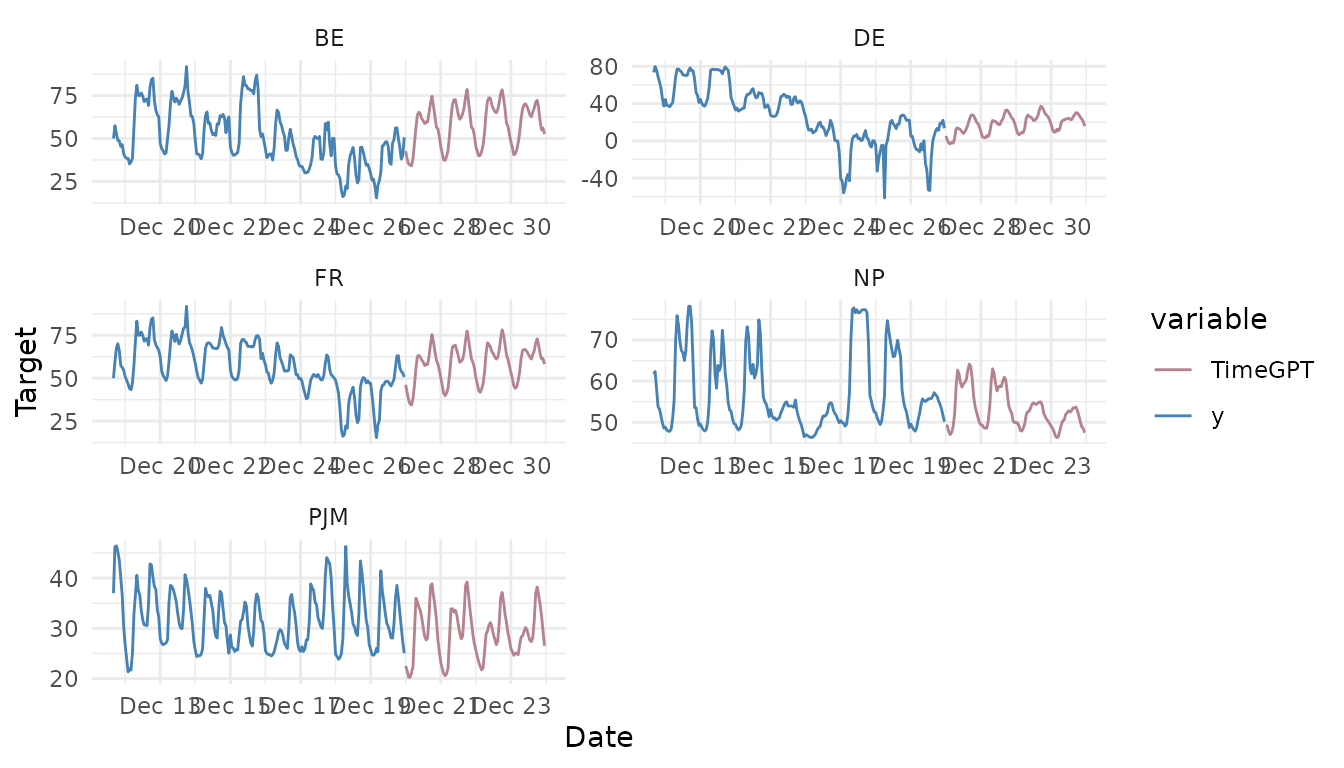

nixtlar includes a function to plot the historical data

and any output from nixtlar::nixtla_client_forecast,

nixtlar::nixtla_client_historic,

nixtlar::nixtla_client_detect_anomalies and

nixtlar::nixtla_client_cross_validation. If you have long

series, you can use max_insample_length to only plot the

last N historical values (the forecast will always be plotted in

full).

nixtlar::nixtla_client_plot(train, fcst_long_horizon, max_insample_length = 200)

5. Evaluate the long-horizon model

To evaluate the long-horizon forecast, we will generate the same

forecast with the default model of TimeGPT, which is

timegpt-1, and then we will compute and compare the Mean Absolute

Error (MAE) of the two models.

fcst <- nixtlar::nixtla_client_forecast(train, h=96)

#> Frequency chosen: h

#> The specified horizon h exceeds the model horizon. This may lead to less accurate forecasts. Please consider using a smaller horizon.

head(fcst)

#> unique_id ds TimeGPT

#> 1 BE 2016-12-27 00:00:00 45.21921

#> 2 BE 2016-12-27 01:00:00 42.56666

#> 3 BE 2016-12-27 02:00:00 41.55990

#> 4 BE 2016-12-27 03:00:00 39.12502

#> 5 BE 2016-12-27 04:00:00 36.47087

#> 6 BE 2016-12-27 05:00:00 37.22281We will rename the TimeGPT long-horizon model to merge

it with the default TimeGPT model. After that, we will

combine them with the actual values from the test set and compute the

MAE. Note that in the output of the nixtla_client_forecast

function, the ds column contains dates. This is because

nixtla_client_plot uses the dates for plotting. However, to

merge the actual values, we will convert the dates to characters.

names(fcst_long_horizon)[which(names(fcst_long_horizon) == "TimeGPT")] <- "TimeGPT-long-horizon"

res <- merge(fcst, fcst_long_horizon) # merge TimeGPT and TimeGPT-long-horizon

res$ds <- as.character(res$ds)

res <- merge(test, res) # merge with actual values

head(res)

#> unique_id ds y TimeGPT TimeGPT-long-horizon

#> 1 BE 2016-12-27 01:00:00 38.33 42.56666 38.03184

#> 2 BE 2016-12-27 02:00:00 41.04 41.55990 35.11706

#> 3 BE 2016-12-27 03:00:00 34.62 39.12502 34.53464

#> 4 BE 2016-12-27 04:00:00 29.69 36.47087 34.11326

#> 5 BE 2016-12-27 05:00:00 28.35 37.22281 38.36180

#> 6 BE 2016-12-27 06:00:00 30.99 42.28119 47.14175

print(paste0("MAE TimeGPT: ", mean(abs(res$y-res$TimeGPT))))

#> [1] "MAE TimeGPT: 8.89928802286956"

print(paste0("MAE TimeGPT long-horizon: ", mean(abs(res$y-res$`TimeGPT-long-horizon`))))

#> [1] "MAE TimeGPT long-horizon: 7.09790721521739"As we can see, the long-horizon version of TimeGPT

produced a model with a lower MAE than the default TimeGPT

model.