1. Uncertainty quantification via quantiles

For uncertainty quantification, TimeGPT can generate

both prediction intervals and quantiles, offering a measure of the range

of potential outcomes rather than just a single point forecast. In

real-life scenarios, forecasting often requires considering multiple

alternatives, not just one prediction. This vignette will explain how to

use quantiles with TimeGPT via the nixtlar

package.

Quantiles represent the cumulative proportion of the forecast

distribution. For instance, the 90th quantile is the value below which

90% of the data points are expected to fall. Notably, the 50th quantile

corresponds to the median forecast value provided by

TimeGPT. The quantiles are produced using conformal

prediction, a framework for creating distribution-free uncertainty

intervals for predictive models.

This vignette assumes you have already set up your API key. If you haven’t done this, please read the Get Started vignette first.

2. Load data

For this vignette, we will use the electricity consumption dataset

that is included in nixtlar, which contains the hourly

prices of five different electricity markets.

df <- nixtlar::electricity

head(df)

#> unique_id ds y

#> 1 BE 2016-10-22 00:00:00 70.00

#> 2 BE 2016-10-22 01:00:00 37.10

#> 3 BE 2016-10-22 02:00:00 37.10

#> 4 BE 2016-10-22 03:00:00 44.75

#> 5 BE 2016-10-22 04:00:00 37.10

#> 6 BE 2016-10-22 05:00:00 35.613. Forecast with quantiles

TimeGPT can generate quantiles when using the following

functions:

- nixtlar::nixtla_client_forecast()

- nixtlar::nixtla_client_historic()

- nixtlar::nixtla_client_cross_validation()For any of these functions, simply set the quantiles

argument to the desired values as a vector. Keep in mind that quantiles

should all be numbers between 0 and 1. You can use either

quantiles or level for uncertainty

quantification, but not both.

fcst <- nixtla_client_forecast(df, h = 8, quantiles = c(0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, 0.9))

#> Frequency chosen: h

head(fcst)

#> unique_id ds TimeGPT TimeGPT-q-10 TimeGPT-q-20 TimeGPT-q-30

#> 1 BE 2016-12-31 00:00:00 45.19067 35.50871 38.47807 40.71672

#> 2 BE 2016-12-31 01:00:00 43.24491 35.37606 37.77021 39.32019

#> 3 BE 2016-12-31 02:00:00 41.95889 35.34064 37.21904 39.44587

#> 4 BE 2016-12-31 03:00:00 39.79668 32.32713 34.98742 35.96046

#> 5 BE 2016-12-31 04:00:00 39.20456 30.99962 32.74742 34.72213

#> 6 BE 2016-12-31 05:00:00 40.10912 32.43535 34.24889 35.10847

#> TimeGPT-q-40 TimeGPT-q-50 TimeGPT-q-60 TimeGPT-q-70 TimeGPT-q-80 TimeGPT-q-90

#> 1 43.92536 45.19067 46.45599 49.66462 51.90328 54.87264

#> 2 42.58577 43.24491 43.90405 47.16964 48.71962 51.11376

#> 3 40.85597 41.95889 43.06182 44.47191 46.69875 48.57715

#> 4 37.46490 39.79668 42.12846 43.63290 44.60593 47.26623

#> 5 36.01357 39.20456 42.39555 43.68699 45.66169 47.40950

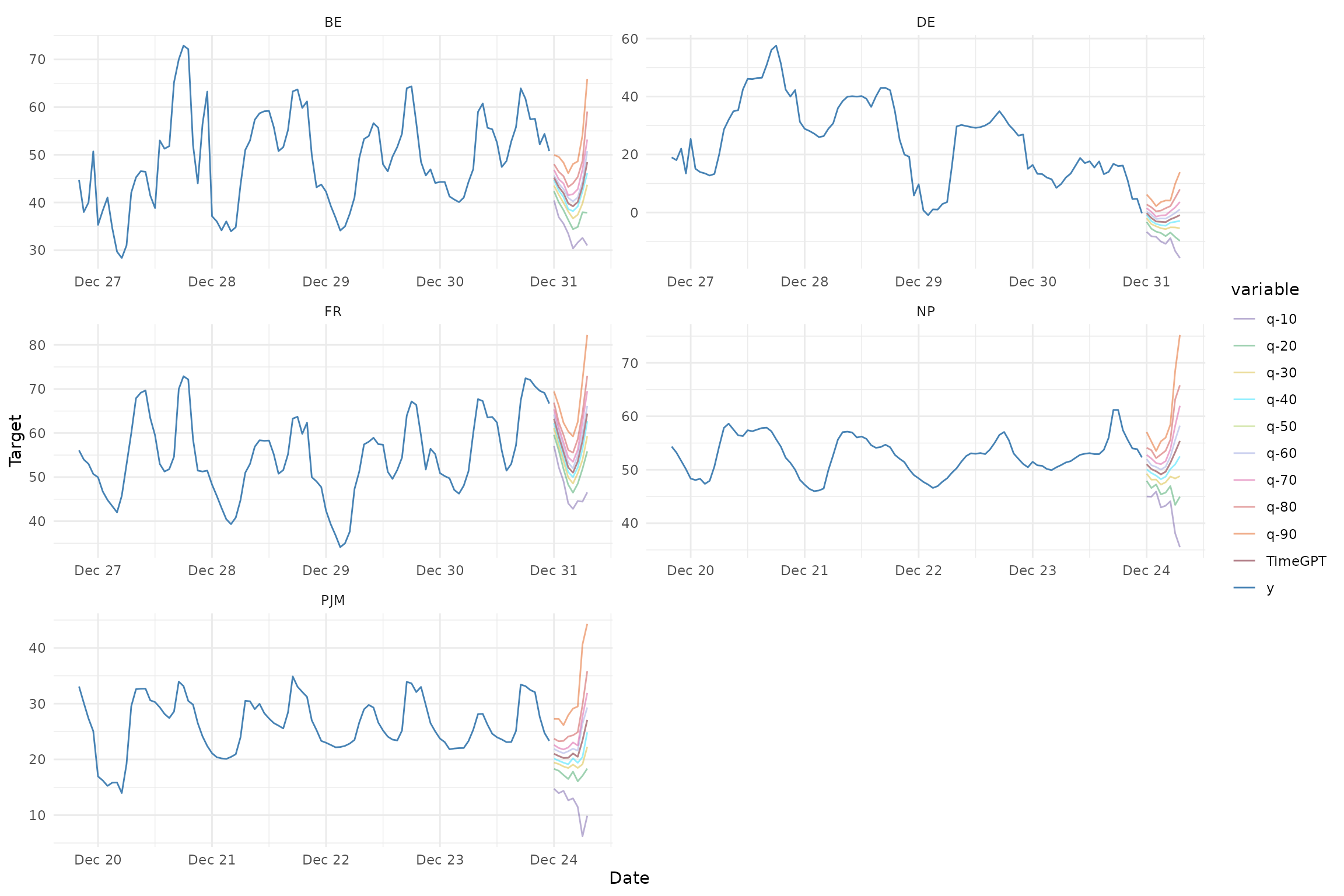

#> 6 38.76706 40.10912 41.45117 45.10976 45.96934 47.782884. Plot quantiles

nixtlar includes a function to plot the historical data

and any output from nixtlar::nixtla_client_forecast,

nixtlar::nixtla_client_historic,

nixtlar::nixtla_client_detect_anomalies and

nixtlar::nixtla_client_cross_validation. If you have long

series, you can use max_insample_length to only plot the

last N historical values (the forecast will always be plotted in

full).

When available, nixtlar::nixtla_client_plot will

automatically plot the quantiles.

nixtla_client_plot(df, fcst, max_insample_length = 100)